Entrust Raises Its Reputation in the Payments Space With Data-Driven Campaign

Cybersecurity company leverages original research to curate timely content and amplify its voice in the payments space.

Overview

Entrust keeps the world moving safely by enabling trusted experiences for identities, payments and digital infrastructure. Amid widespread disruption in the financial services sector, the company enlisted Walker Sands to raise its profile in the payments space by leading the conversation on how the global payments industry was evolving.

The result was a data-driven campaign fueled by an original research report, a series of blog posts and a virtual roundtable discussion that positioned Entrust as an industry thought leader and demonstrated the value of its services in navigating the highly complex payments space.

media placements

The Challenge

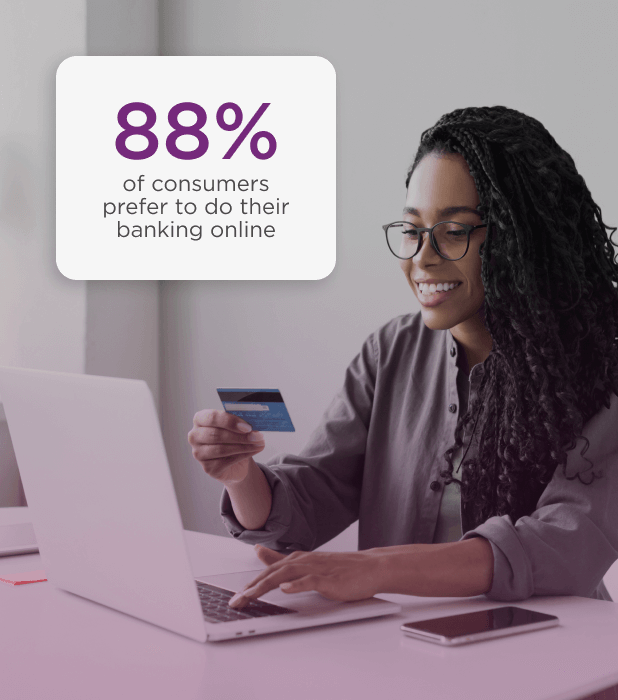

Entrust tasked Walker Sands with elevating its voice in the payments industry. Faced with ongoing digital transformation in banking, the increased adoption of contactless payments, and the growing popularity of cryptocurrencies, the brand needed a vehicle to share insights about evolving trends and garner media attention, positioning itself as a go-to expert in the space.

The Solution

To enhance Entrust’s visibility and influence in the payments industry, Walker Sands recommended an original research survey to understand consumer sentiment surrounding the disruption of payments. The report would equip Entrust with key data points to support its payments industry predictions, while continuing to promote core areas of Entrust’s business. The report and supporting content would then be used to capture the attention of relevant media outlets and payment industry leaders by presenting breakthrough data that offered a fresh, compelling perspective on the future of the payments space.

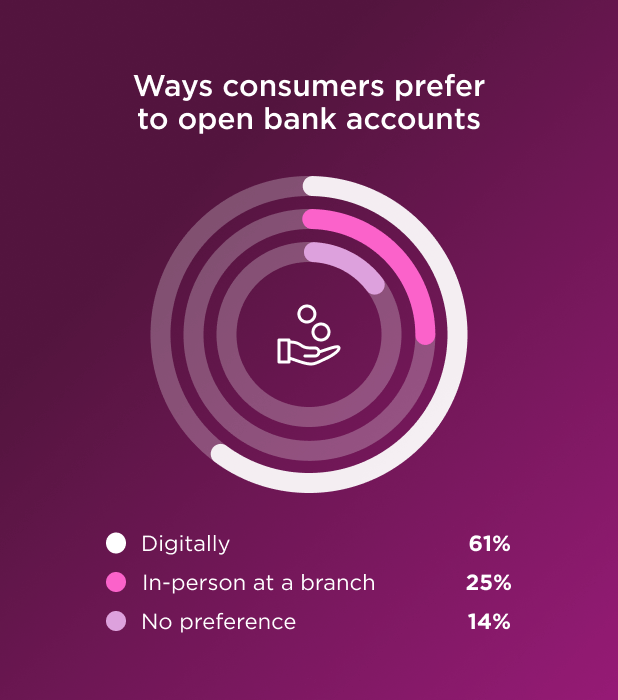

The Walker Sands team kicked off the data-driven campaign by developing a survey that explored sentiments and behaviors around omnichannel touchpoints, flexible payment options, the future of digital payments and banking security.

Since Entrust is a global company with operations spanning multiple continents, the campaign clearly needed to be global. This wide geographic scope added complexity to the project, including the need to manage multiple survey translations and data collection across nine countries, from Singapore to Saudi Arabia. But despite the challenges, the inclusion of multiple geographies in the survey would ensure the data’s relevance to Entrust’s global audiences, while resonating with press outlets in the U.S.

With the survey results in hand, our team hosted a strategy call with Entrust’s spokespeople — respected thought leaders in the payments industry — to hear their perspectives on the data findings. We then merged Entrust’s insights with the most relevant data points to create a report that highlighted the most media-worthy data and analysis. As our Content team shaped the narrative for the report and its supporting assets, we also incorporated feedback from Entrust’s global agency partners to ensure messaging reflected an international perspective.

The resulting 15-page, designed research report entitled “The Great Payments Disruption” discussed the boom of digital-first banking options and how revolutionary technologies are creating a new banking landscape. It also touched on how financial services and payments firms should approach these changes through the lens of consumer preferences. The report’s overarching messaging tied back to the utility of Entrust’s service offerings for streamlining digital transformation journeys.

To maximize coverage for Entrust, we supported the launch of the report with a strategic PR plan that leveraged the study’s findings and insights for top-tier and trade media outreach, as well as thought leadership opportunities.

In addition to the research report, our Content team drafted three supplemental blog posts — the first on consumers’ desire for a digital-first banking experience, the second on consumer fears about digital bank fraud and the third on using digitally issued cards. Published on Entrust’s website, the blogs served as further avenues to promote “The Great Payments Disruption” report.

Finally, Walker Sands wrote and designed assets for a complimentary virtual roundtable — a stage of the campaign designed to touch on the human element of purchasing behavior that is driving the “Great Payments Disruption.” The virtual roundtable event, complete with a customized slide deck and script for an Entrust moderator, allowed Entrust to break down consumer insights on banking technology from the report.

The Results

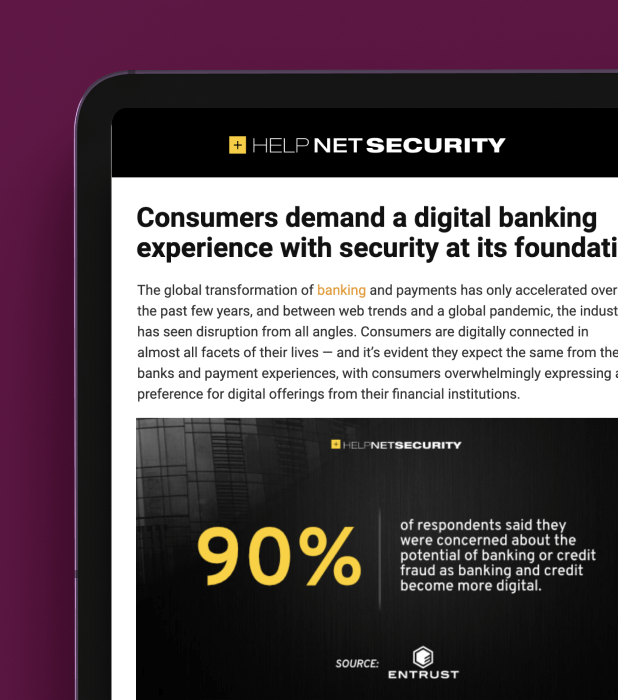

The “Great Payments Disruption” campaign garnered 124 total media placements from Walker Sands and Entrust’s global agency partners, exceeding initial goals by nearly 6x. Feature placements in key trade outlets like InfoSecurity Magazine, Help Net Security, Payments Cards and Mobile, CU Today and Credit Union Times were significant because they enabled Entrust to reach leaders across the financial services industry.

The accompanying blog posts not only drove additional traffic to the report’s landing page for downloads, but reinforced Entrust’s status as a thought leader and valuable partner in understanding and navigating ongoing payments disruption.

The virtual roundtable successfully extended the usage of Entrust’s data by creating a digital moment that centered around the report’s findings and Entrust’s product offerings. Ultimately, the campaign played an important role in cementing Entrust’s status as a leader in the payments industry.